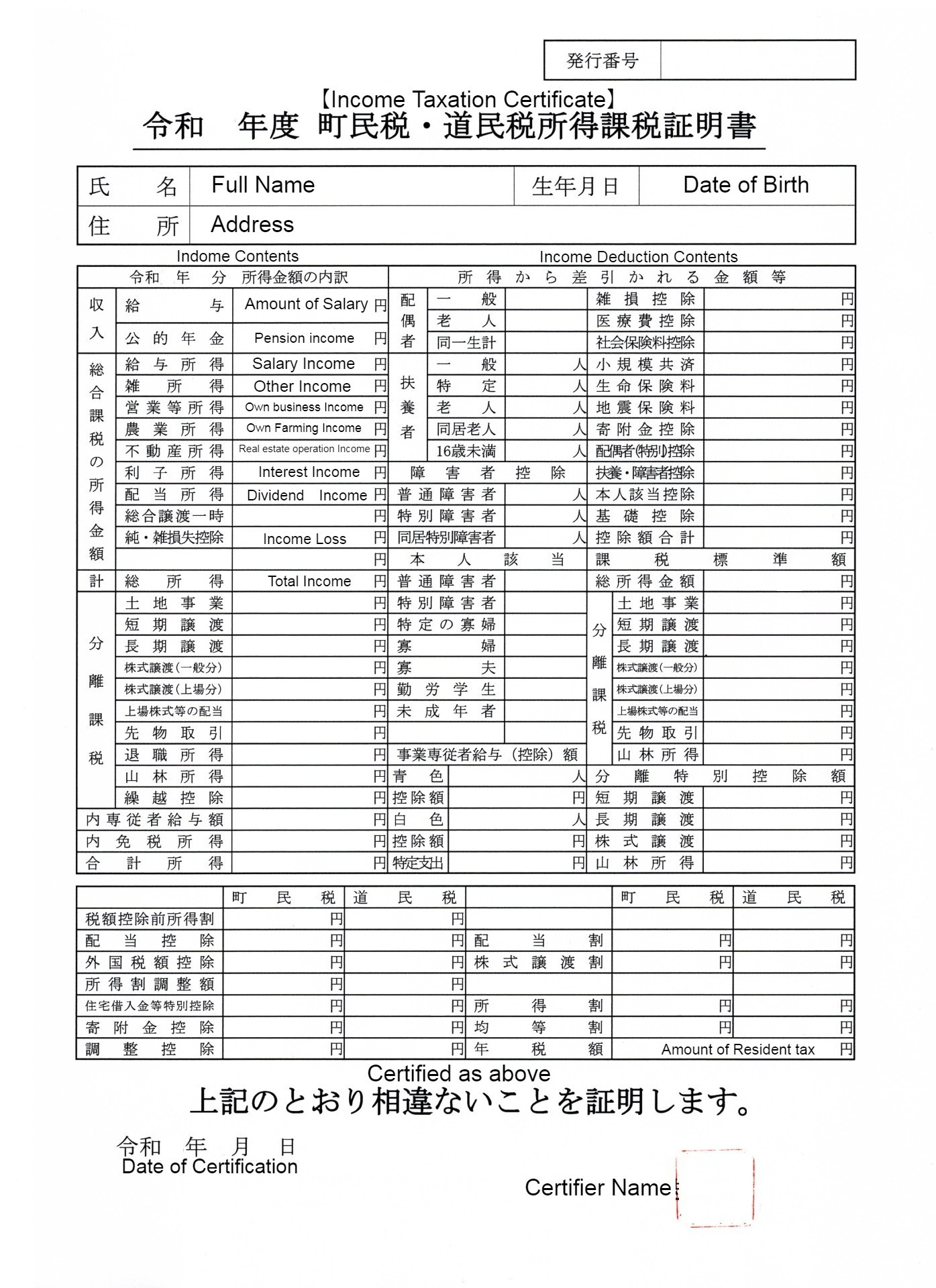

Name

- English

- Income Taxation Certificate

- Japanese

- 所得課税証明書

Summary

Document recording the amount of municipal and prefectural tax paid on your income from January to December of a given year, this is for the municipality you live in on January 1st.

Use

You need this document for: Bank loans, Visa applications, Naturalisation application, Public housing rent calculation, Nursery fee calculation, Pension procedure, Child allowance application

A way of acquisition

At the municipality office where you live on January 1st, bring your "Residence Card".

Or you can apply by mail, you will need an application form, a copy of your residence card, a "Postal Money Order” for the fee, and a postage stamp reply envelope.

Fee

Around 300 yen, it may be free depending on the purpose you need it for.

Notes

The latest income certificate can be acquired from mid-May to early June of the following year.

For some municipalities tax exemption is shown on an Income Certificate instead.